EaseMyTrip has announced its Q1 FY26 earnings, and the results are a mixed bag. While the company saw impressive growth in hotels and non-air bookings, its overall numbers took a sharp hit, with profits nearly wiped out.

Revenue and Profit Take a Hit

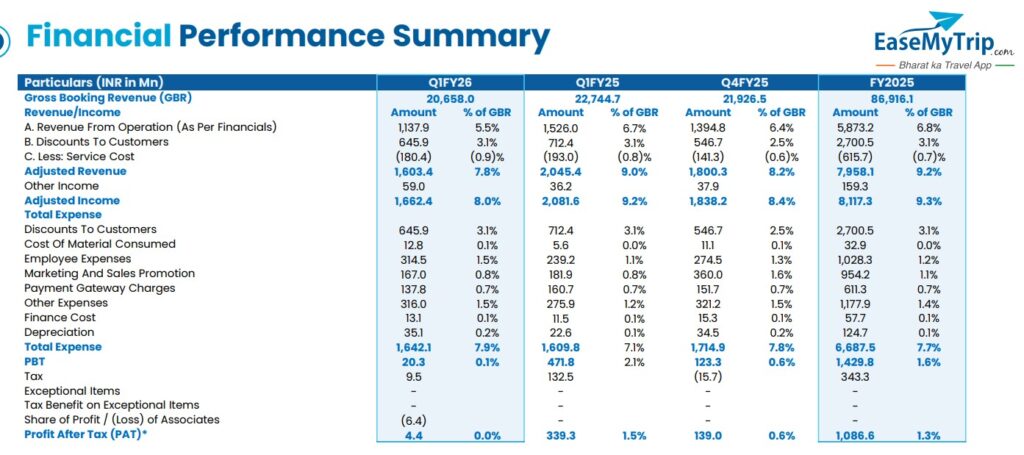

Revenue from operations came in at ₹113.8 crore, down more than 25% compared to the same quarter last year. Net profit plunged 98.6% year-on-year to just ₹44.3 lakh, compared to ₹33.93 crore in Q1 FY25.

The big reason behind the fall? Air ticketing, which usually makes up half of EaseMyTrip’s business, slumped 47% to ₹57 crore, versus ₹107 crore in the year-ago quarter.

Hotel packages, however, contributed a solid 28.5% of total revenue, generating ₹32.5 crore.

Strong Growth in Non-Air Segments

Even though profits collapsed, EaseMyTrip’s non-air categories are showing strong momentum. Hotel and holiday bookings jumped 81.2% year-on-year, while train, bus, and other bookings grew 41.4%.

Founder and Chairman Nishant Pitti highlighted this resilience, saying the company recorded a Gross Booking Revenue (GBR) of ₹2,065.8 crore in Q1 FY26, powered by hotels and packages growth. The segment clocked 3.3 lakh room nights versus 1.8 lakh last year, averaging 3,637 room nights per day.

Flight bookings remained steady too, with an average of 24,230 flight segments booked daily. Pitti also noted that Dubai operations stood out, posting a 151% jump in GBR to ₹318.1 crore, up from ₹126.7 crore a year ago.

Aggressive Expansion Moves

EaseMyTrip committed ₹370 crore across three acquisitions during the quarter. These include a 50% stake in UK-based Three Falcons Notting Hill, full ownership of AB Finance, and an additional investment in Vashu Bhagnani Industries.

The company also launched its “Azadi Mega Sale,” offering discounts across flights, hotels, and holiday packages to attract more customers.

Stock Performance

EaseMyTrip’s shares closed 4% higher at ₹9.22 on Thursday. However, its long-term stock performance has been weak, with the share price sliding significantly over the past year.