If you’ve been spotting more Swiggy delivery partners zipping past you lately, the company’s latest numbers explain why. Food delivery and quick-commerce major Swiggy Ltd announced its Q3 FY26 results on January 29, 2026, and the story is clear: rapid growth, but at a heavy price.

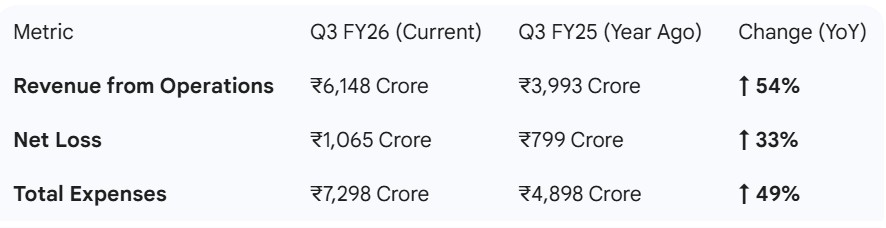

Swiggy posted a sharp 54% year-on-year (YoY) jump in revenue, clocking ₹6,148 crore for the December quarter. However, this aggressive expansion came with a downside, as the company’s net losses widened compared to the same quarter last year.

Instamart Steals the Spotlight

Swiggy Instamart continues to fire on all cylinders as more consumers choose quick deliveries over traditional grocery shopping.

103% Growth: Instamart’s Gross Order Value (GOV) more than doubled YoY to ₹7,938 crore.

Dark Store Expansion: The company added 34 new dark stores during the quarter, taking the total to 1,136 stores spread across 131 cities.

Bigger Baskets: The Average Order Value (AOV) climbed to ₹746, as customers moved beyond daily essentials to buy electronics, apparel, and home products.

Food Delivery Hits New Highs

Concerns about a slowdown in the food delivery space didn’t show up in Swiggy’s numbers.

The food delivery business recorded its strongest growth in three years, with GOV rising 20.5% to ₹8,959 crore. Monthly Transacting Users (MTU) increased to 18.1 million, highlighting that ordering food online is becoming an even stronger habit.

So, Why Are Losses Still Rising?

With such strong growth, the big question remains: why is Swiggy still losing more than ₹1,000 crore every quarter? The answer lies in heavy spending on marketing and infrastructure.

During the quarter, Swiggy spent ₹1,108 crore on advertising and sales promotions, up 47% year-on-year. Intense competition with players like Zomato and Zepto, along with major investments in Instamart’s warehouse network, has kept operating costs elevated.

Investors are closely tracking Swiggy’s journey toward profitability. While widening losses may raise concerns, the company has a sizeable cash reserve of ₹15,900 crore, including funds from its recent QIP and the sale of its stake in Rapido. This strong balance sheet gives Swiggy enough firepower to stay in the delivery race for the long haul.