It’s been a packed week for Anil Agarwal-led Vedanta Limited. Just days after announcing a stake sale in subsidiary Hindustan Zinc, the mining major has unveiled its Q3 FY26 results (for the quarter ended December 2024). And the numbers clearly reflect a company in expansion mode.

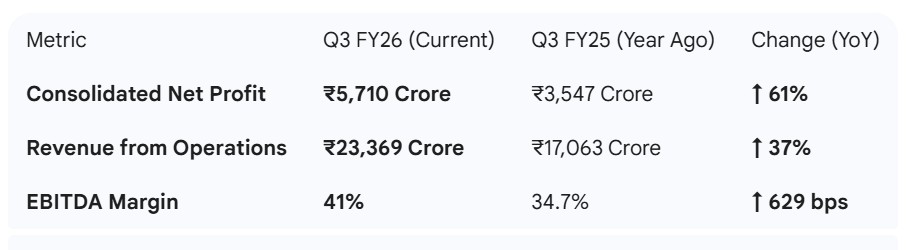

Vedanta didn’t just post growth; it delivered a sharp surge in profits. The company rode on higher global prices of aluminium, zinc, and silver, while tighter cost control added an extra boost to the bottom line.

Revenue from the aluminium business climbed to ₹16,866 crore. Strong silver prices significantly lifted margins, while aluminium production costs dropped by 11%. In simple terms, Vedanta earned more on every tonne it sold.

The ‘Vedanta 2.0’ Push: Five Companies in the Making

One of the biggest highlights of the quarterly update is progress on Vedanta’s long-awaited demerger. The company has secured key approvals, including from the NCLT, to split its operations into five independent, listed entities:

- Vedanta Aluminum

- Vedanta Oil & Gas

- Vedanta Power

- Vedanta Steel and Ferrous Materials

- Vedanta Limited (which will house zinc and other businesses)

So why should investors care? The idea is to “unlock value.” Instead of holding shares in one massive, diversified company, shareholders will eventually own stakes in five focused businesses. Such structures are often easier for markets to value—and that can sometimes translate into better stock performance.

Debt Watch: Balance Sheet Looks Stronger

Vedanta has long faced scrutiny over its debt levels, but the Q3 numbers suggest steady improvement.

Net Debt: ₹60,624 crore

Leverage: Net Debt-to-EBITDA ratio improved to 1.23x from 1.40x last year

Put simply, Vedanta is earning more than it owes, signalling a healthier financial position.

At the moment, Vedanta appears to be firing on all cylinders. While the group continues to sell small stakes in subsidiaries like Hindustan Zinc to improve liquidity, its core businesses are delivering strong profits. If global metal prices remain firm and the demerger stays on track, the Anil Agarwal-led group could continue to shine on Dalal Street.