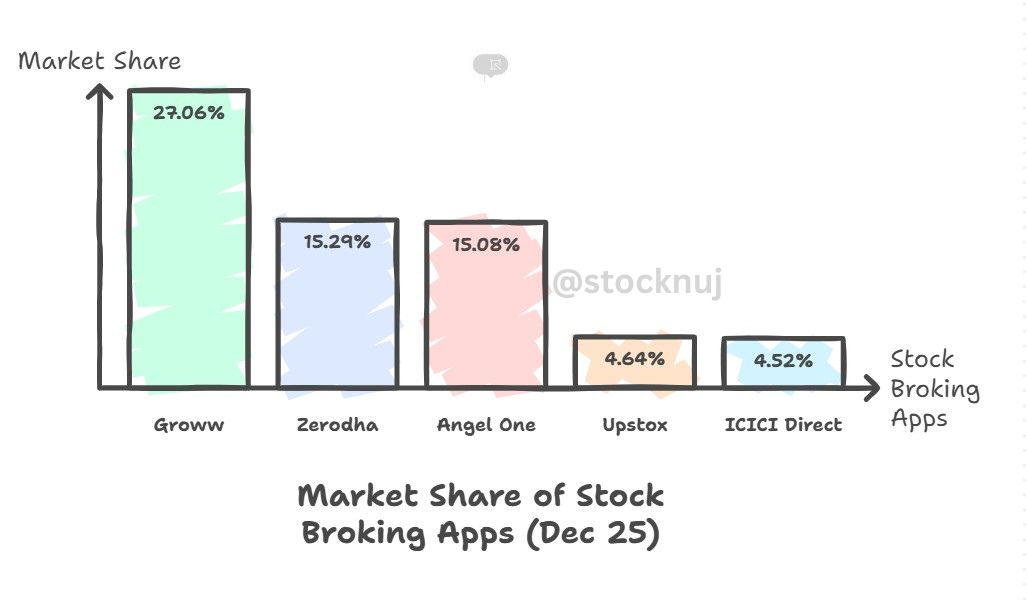

India’s stock market ecosystem is evolving fast, and digital stock broking apps are at the center of this change. As more retail investors enter the market, competition among broking platforms has intensified. The latest market share data for December 2025 offers a clear picture of which apps are winning user trust and attention.

Market Share of Stock Broking Apps (December 2025)

- Groww: 27.06%

- Zerodha: 15.29%

- Angel One: 15.08%

- Upstox: 4.64%

- ICICI Direct: 4.52%

Groww has emerged as the market leader, holding a commanding 27.06% share. Its strong performance reflects the platform’s growing popularity among first-time investors as well as seasoned traders. A simple interface, smooth onboarding, and a wide range of investment options have helped Groww build a large and loyal user base.

Zerodha and Angel One are engaged in a close contest for the second spot. Zerodha holds a 15.29% market share, staying marginally ahead of Angel One, which stands at 15.08%. Zerodha continues to attract serious traders with its low-cost structure and reliable trading tools. At the same time, Angel One’s focus on advisory services, research, and technology-driven features has helped it stay competitive.

Upstox ranks next with a 4.64% share. Although its market share is significantly lower than the top three players, Upstox remains a preferred choice for many active traders due to its pricing model and trading-focused features. The platform continues to expand its reach in a highly competitive space.

ICICI Direct follows closely with a 4.52% market share. Backed by the ICICI brand, the platform appeals to investors who prefer the stability of a bank-backed broking service. Its strong integration with banking services and focus on long-term investors continue to define its positioning in the market.

Overall, the December 2025 data highlights a clear shift in investor preferences toward digital-first platforms that offer ease of use, low costs, and quick access to multiple investment products. As competition intensifies, stock broking apps are expected to invest more in technology, user experience, and value-added services to attract and retain investors in the months ahead.